Multiple Choice

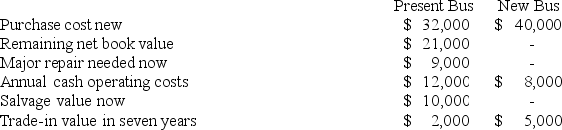

Morrel University has a small shuttle bus that is in poor mechanical condition. The bus can be either overhauled now or replaced with a new shuttle bus. The following data have been gathered concerning these two alternatives (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The University could continue to use the present bus for the next seven years. Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years. The University uses a discount rate of 12% and the total cost approach to net present value analysis.

If the present bus is repaired, the present value of the annual cash operating costs associated with this alternative is closest to:

A) $(36,500)

B) $(16,200)

C) $(47,200)

D) $(54,800)

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Respass Corporation has provided the following data

Q76: Jojola Corporation is investigating buying a small

Q80: Almendarez Corporation is considering the purchase of

Q81: The following data pertain to an investment

Q82: Cabe Corporation uses a discount rate of

Q83: Olinick Corporation is considering a project that

Q84: Purvell Corporation has just acquired a new

Q177: A project has an initial investment of

Q373: A company has unlimited funds to invest

Q391: The internal rate of return is computed