Multiple Choice

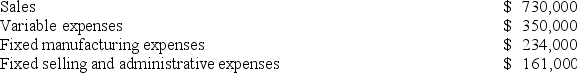

Product U23N has been considered a drag on profits at Jinkerson Corporation for some time and management is considering discontinuing the product altogether. Data from the company's budget for the upcoming year appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

A) $15,000

B) $143,000

C) ($143,000)

D) ($15,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a company has a production constraint,

Q77: Future costs that do not differ between

Q187: Younes Inc. manufactures industrial components. One of

Q189: Mae Refiners, Inc., processes sugar cane that

Q190: Landor Appliance Corporation makes and sells electric

Q191: The Melville Corporation produces a single product

Q196: The constraint at Pickrel Corporation is time

Q231: In a decision to drop a product,

Q367: The Carter Corporation makes products A and

Q432: Hamby Corporation is preparing a bid for