Multiple Choice

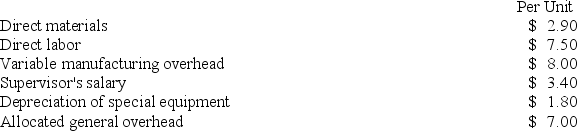

Part U16 is used by Mcvean Corporation to make one of its products. A total of 13,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make the part and sell it to the company for $29.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part U16 could be used to make more of one of the company's other products, generating an additional segment margin of $25,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part U16 from the outside supplier should be:

An outside supplier has offered to make the part and sell it to the company for $29.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make part U16 could be used to make more of one of the company's other products, generating an additional segment margin of $25,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part U16 from the outside supplier should be:

A) $25,000

B) ($79,000)

C) ($35,400)

D) $14,600

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Boney Corporation processes sugar beets that it

Q93: The management of Bonga Corporation is considering

Q94: Brissett Corporation makes three products that use

Q95: Wehrs Corporation has received a request for

Q100: Vannorman Corporation processes sugar beets in batches.

Q100: Two alternatives, code-named X and Y, are

Q118: Kahn Corporation (a multi-product company) produces and

Q175: Otool Inc.is considering using stocks of an

Q298: Boney Corporation processes sugar beets that it

Q341: Sunk costs are costs that have proven