Multiple Choice

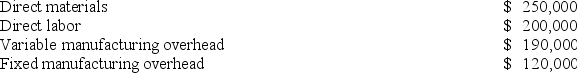

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:  Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

At what price per unit charged by the outside supplier would Melbourne be indifferent between making or buying the subcomponent?

A) $29 per unit

B) $25 per unit

C) $21 per unit

D) $24 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Boney Corporation processes sugar beets that it

Q82: Juliani Company produces a single product.

Q83: Holden Corporation produces three products, with costs

Q84: Penagos Corporation is presently making part Z43

Q85: Bertucci Corporation makes three products that use

Q86: Mcfarlain Corporation is presently making part U98

Q88: Mae Refiners, Inc., processes sugar cane that

Q89: The constraint at Dreyfus Inc. is an

Q90: The Cook Corporation has two divisions--East and

Q91: Prosner Corp. manufactures three products from