Multiple Choice

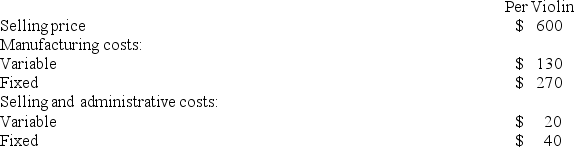

The Bharu Violin Corporation has the capacity to manufacture and sell 5,000 violins each year but is currently only manufacturing and selling 4,800. The following data relate to annual operations at 4,800 units:  Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.

Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.

If the special order from Woolgar Symphony Orchestra is accepted, the financial advantage (disadvantage) Bharu for the year should be:

A) $40,000

B) ($10,000)

C) ($22,000)

D) ($28,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q103: Costs associated with two alternatives, code-named Q

Q104: Vanik Corporation currently has two divisions which

Q106: The management of Woznick Corporation has been

Q107: Suire Corporation is considering dropping product D14E.

Q111: In a sell or process further decision,consider

Q111: Kneller Co. manufactures and sells medals for

Q113: The Wester Corporation produces three products with

Q167: Boney Corporation processes sugar beets that it

Q243: Future costs that do differ among the

Q354: The Tolar Corporation has 400 obsolete desk