Multiple Choice

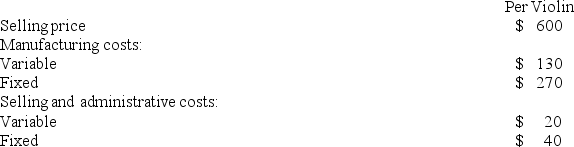

The Bharu Violin Corporation has the capacity to manufacture and sell 5,000 violins each year but is currently only manufacturing and selling 4,800. The following data relate to annual operations at 4,800 units:  Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.

Woolgar Symphony Orchestra is interested in purchasing Bharu's excess capacity of 200 units but only if they can get the violins for $350 each. This special order would not affect regular sales or the total fixed costs.

Assume that Bharu is manufacturing and selling at capacity (5,000 units) . Any special order will mean a loss of regular sales. Under these conditions if the special order from Woolgar Symphony Orchestra is accepted, the financial advantage (disadvantage) Bharu for the year should be:

A) $20,000

B) ($22,000)

C) ($28,000)

D) ($50,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a company has a production constraint,

Q71: Cybil Baunt just inherited a 1958 Chevy

Q112: A joint product is:<br>A) any product which

Q179: Part U67 is used in one

Q180: Younes Inc. manufactures industrial components. One of

Q182: Janeiro Skate, Inc. currently manufactures the

Q186: A customer has asked Lalka Corporation to

Q187: Younes Inc. manufactures industrial components. One of

Q189: Mae Refiners, Inc., processes sugar cane that

Q258: It may be a good decision to