Multiple Choice

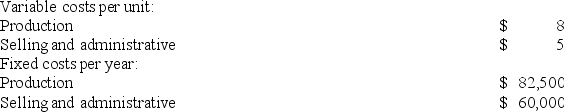

Erie Corporation manufactures a single product that it sells for $35 per unit. The company has the following cost structure:  There were no units in inventory at the beginning of the year. During the year 30,000 units were produced and 25,000 units were sold.

There were no units in inventory at the beginning of the year. During the year 30,000 units were produced and 25,000 units were sold.

Under absorption costing, the unit product cost would be:

A) $8.00 per unit

B) $17.75 per unit

C) $13.00 per unit

D) $10.75 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q72: Allocating common fixed expenses to business segments:<br>A)

Q237: Shun Corporation manufactures and sells a hand

Q239: Data for January for Bondi Corporation and

Q240: Nuzum Corporation has two divisions: Division M

Q241: Azuki Corporation operates in two sales territories,

Q243: Zable Corporation has two divisions: Town Division

Q244: Moskowitz Corporation has provided the following data

Q245: A manufacturing company that produces a single

Q246: Krepps Corporation produces a single product. Last

Q247: Janos Corporation, which has only one product,