Multiple Choice

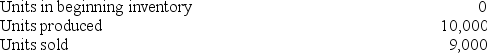

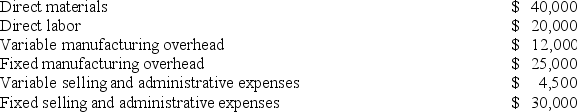

Kern Corporation produces a single product. Selected information concerning the operations of the company follow:

Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

Which costing method, absorption or variable costing, would show a higher operating income for the year and by what amount?

A) Absorption costing net operating income would be higher than variable costing net operating income by $2,500.

B) Variable costing net operating income would be higher than absorption costing net operating income by $2,500.

C) Absorption costing net operating income would be higher than variable costing net operating income by $5,500.

D) Variable costing net operating income would be higher than absorption costing net operating income by $5,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A company that produces a single product

Q186: Variable costing is more compatible with cost-volume-profit

Q210: A manufacturing company that produces a single

Q211: Aaron Corporation, which has only one product,

Q213: Wyrich Corporation has two divisions: Blue Division

Q216: Lenart Corporation has provided the following data

Q217: The Southern Corporation manufactures a single product

Q218: Davitt Corporation produces a single product and

Q219: Sherwood Corporation has provided the following data

Q220: Bryans Corporation has provided the following data