Essay

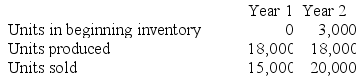

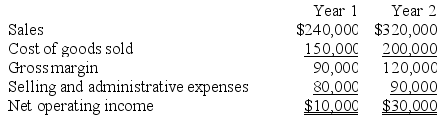

Fowler Corporation manufactures a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This fixed manufacturing overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This fixed manufacturing overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Correct Answer:

Verified

a. The unit product cost under variable ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q244: Moskowitz Corporation has provided the following data

Q245: A manufacturing company that produces a single

Q246: Krepps Corporation produces a single product. Last

Q247: Janos Corporation, which has only one product,

Q248: Elbrege Corporation manufactures a single product. The

Q250: Mandato Corporation has provided the following data

Q251: Azuki Corporation operates in two sales territories,

Q252: Clemeson Corporation, which has only one product,

Q254: Elison Corporation, which has only one product,

Q390: Allocating common fixed costs to segments on