Multiple Choice

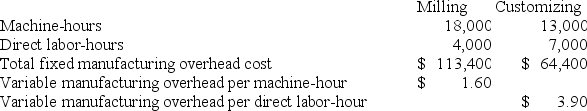

Comans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A319. The following data were recorded for this job:

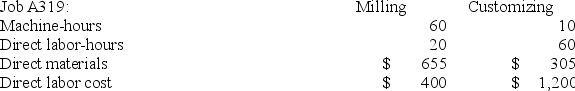

During the current month the company started and finished Job A319. The following data were recorded for this job: The amount of overhead applied in the Customizing Department to Job A319 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job A319 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $234.00

B) $786.00

C) $552.00

D) $91,700.00

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Which of the following is the correct

Q150: Macnamara Corporation has two manufacturing departments--Casting and

Q151: Levron Corporation uses a job-order costing system

Q152: Sivret Corporation uses a job-order costing system

Q153: Kroeker Corporation has two production departments, Milling

Q156: Janicki Corporation has two manufacturing departments--Machining and

Q157: Beans Corporation uses a job-order costing system

Q159: Ronson Corporation has two manufacturing departments--Casting and

Q211: Levi Corporation uses a predetermined overhead rate

Q307: A company will improve job cost accuracy