Multiple Choice

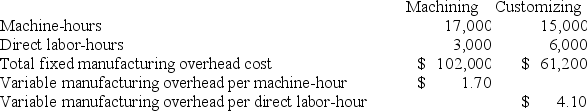

Collini Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T268. The following data were recorded for this job:

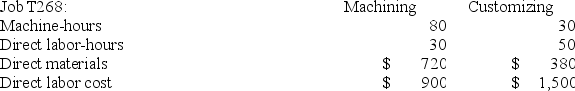

During the current month the company started and finished Job T268. The following data were recorded for this job: If the company marks up its manufacturing costs by 40% then the selling price for Job T268 would be closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its manufacturing costs by 40% then the selling price for Job T268 would be closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1,932.40

B) $6,763.40

C) $4,831.00

D) $7,440.00

Correct Answer:

Verified

Correct Answer:

Verified

Q112: Helland Corporation uses a job-order costing system

Q113: Tiff Corporation has two production departments, Casting

Q114: Thach Corporation uses a job-order costing system

Q115: Branin Corporation uses a job-order costing system

Q116: Merati Corporation has two manufacturing departments--Forming and

Q118: Leeds Corporation uses a job-order costing system

Q119: Dehner Corporation uses a job-order costing system

Q121: Dehner Corporation uses a job-order costing system

Q122: Braegelmann Corporation has two production departments, Casting

Q305: In absorption costing, nonmanufacturing costs are assigned