Essay

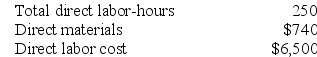

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 20,000 direct labor-hours, total fixed manufacturing overhead cost of $182,000, and a variable manufacturing overhead rate of $2.50 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%.

Correct Answer:

Verified

Estimated total manufacturing overhead c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: Sutter Corporation uses a job-order costing system

Q34: Temby Corporation uses a job-order costing system

Q35: Cull Corporation uses a job-order costing system

Q36: Eisentrout Corporation has two production departments, Machining

Q39: Comans Corporation has two production departments, Milling

Q40: Decorte Corporation uses a job-order costing system

Q41: Prather Corporation uses a job-order costing system

Q43: Kalp Corporation has two production departments, Machining

Q241: Meenach Corporation uses a job-order costing system

Q399: Valvano Corporation uses a job-order costing system