Essay

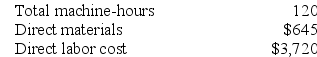

Saxon Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 10,000 machine-hours, total fixed manufacturing overhead cost of $91,000, and a variable manufacturing overhead rate of $2.40 per machine-hour. Job K373, which was for 60 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

a. Calculate the estimated total manufacturing overhead for the year.

b. Calculate the predetermined overhead rate for the year.

c. Calculate the amount of overhead applied to Job K373.

d. Calculate the total job cost for Job K373.

e. Calculate the unit product cost for Job K373.

Correct Answer:

Verified

a. Estimated total manufacturing overhea...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: A bill of materials is a document

Q156: The appeal of using multiple departmental overhead

Q190: Vasilopoulos Corporation has two production departments, Casting

Q191: Opunui Corporation has two manufacturing departments--Molding and

Q192: Lupo Corporation uses a job-order costing system

Q193: Barbeau Corporation has two production departments, Milling

Q194: Kubes Corporation uses a job-order costing system

Q197: Juanita Corporation uses a job-order costing system

Q198: Pebbles Corporation has two manufacturing departments--Casting and

Q200: Petty Corporation has two production departments, Milling