Essay

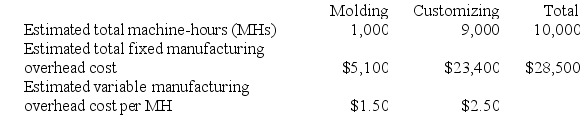

Sonneborn Corporation has two manufacturing departments--Molding and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

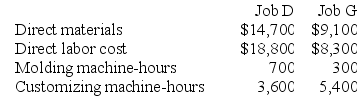

During the most recent month, the company started and completed two jobs--Job D and Job G. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job D and Job G. There were no beginning inventories. Data concerning those two jobs follow:

Required:

Required:

a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job D.

b. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job G.

c. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job D?

d. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. How much manufacturing overhead will be applied to Job G?

Correct Answer:

Verified

a. The first step is to calculate the es...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: In a job-order costing system, costs are

Q211: Harootunian Corporation uses a job-order costing system

Q212: Marioni Corporation has two manufacturing departments--Forming and

Q213: Branin Corporation uses a job-order costing system

Q214: Kostelnik Corporation uses a job-order costing system

Q216: Marciante Corporation has two production departments, Casting

Q217: Vanliere Corporation has two production departments, Machining

Q218: Beans Corporation uses a job-order costing system

Q220: Cardosa Corporation uses a job-order costing system

Q250: Fillmore Corporation uses a job-order costing system