Multiple Choice

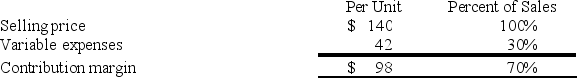

Houpe Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month.

Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month.

Management is considering using a new component that would increase the unit variable cost by $5. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 300 units. What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $2,100

B) decrease of $27,900

C) increase of $2,100

D) increase of $27,900

Correct Answer:

Verified

Correct Answer:

Verified

Q28: A manufacturer of premium wire strippers has

Q29: Hedman Corporation has provided the following contribution

Q30: Hawver Corporation produces and sells a single

Q31: The July contribution format income statement of

Q33: Dietrick Corporation produces and sells two products.

Q34: A manufacturer of cedar shingles has supplied

Q37: Speckman Enterprises, Inc., produces and sells a

Q94: For a given level of sales, a

Q95: Liz,Inc.,produces and sells a single product.The product

Q340: Flesch Corporation produces and sells two products.