Multiple Choice

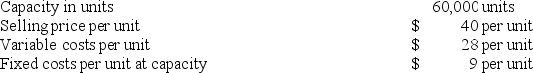

Division A of Tripper Company produces a part that it sells to other companies. Sales and cost data for the part follow:  Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

Assume that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into outside sales. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

A) $40 per unit

B) $39 per unit

C) $28 per unit

D) $27 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q89: Gauani Products, Inc., has a Detector Division

Q91: Ricardo Products, Inc., has a Motor Division

Q92: Brull Products, Inc., has a Sensor Division

Q95: Siegrist Products, Inc., has a Pump Division

Q96: Delemos Products, Inc., has a Transmitter Division

Q97: The Northern Division of Fiscar Corporation sells

Q98: Fingado Products, Inc., has a Detector Division

Q99: Wengert Products, Inc., has a Motor Division

Q101: Division R of Harris Corporation has the

Q212: Two of the decentralized divisions of Gamberi