Essay

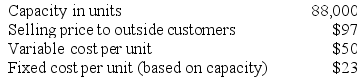

Vandermeer Products, Inc., has a Antennae Division that manufactures and sells a number of products, including a standard antennae. Data concerning that antennae appear below:

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

Required:

a. Assume that the Antennae Division is selling all of the antennaes it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

b. Assume again that the Antennae Division is selling all of the antennaes it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

Correct Answer:

Verified

a. The total contribution margin on lost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Fyodor Corporation has a Parts Division that

Q26: Starcic Products, Inc., has a Connector Division

Q27: Prejean Products, Inc., has a Relay Division

Q28: Bacot Products, Inc., has a Valve Division

Q30: Division P of the Nyers Company makes

Q31: Fregozo Products, Inc., has a Connector Division

Q37: If transfer prices are to be based

Q211: Setting transfer prices at full cost can

Q237: Division E of Harveq Company has the

Q284: Two of the decentralized divisions of Gamberi