Multiple Choice

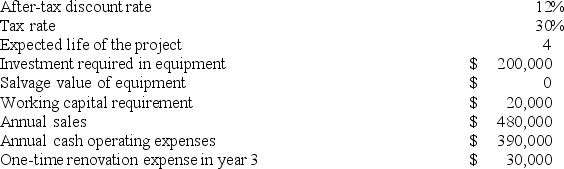

Infante Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment.

The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 2 is:

A) $78,000

B) $63,000

C) $92,000

D) $42,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: McCrohan Corporation is considering a capital budgeting

Q9: Prudencio Corporation has provided the following information

Q11: Shanks Corporation is considering a capital budgeting

Q12: Planas Corporation has provided the following information

Q14: Waltermire Corporation has provided the following information

Q15: Stockinger Corporation has provided the following information

Q17: Mesko Corporation has provided the following information

Q18: Przewozman Corporation has provided the following information

Q235: Depreciation expense is not included in the

Q386: Boynes Corporation is considering a capital budgeting