Multiple Choice

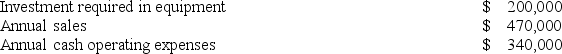

Chene Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

A) $335,914

B) $224,000

C) $169,516

D) $135,914

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Paletta Corporation has provided the following information

Q45: Waltermire Corporation has provided the following information

Q46: Bonomo Corporation has provided the following information

Q49: Padmore Corporation has provided the following information

Q50: Hawthorn Corporation has provided the following information

Q52: Nakama Corporation is considering investing in a

Q53: Layer Corporation has provided the following information

Q107: Olis Corporation is considering a capital budgeting

Q151: When a company invests in equipment, it

Q322: Hinger Corporation is considering a capital budgeting