Essay

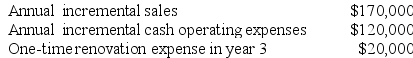

Bellows Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with a 4 year useful life and zero salvage value. Data concerning that project appear below:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 11%.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The company's tax rate is 30% and the after-tax discount rate is 11%.

Required:

Determine the net present value of the project. Show your work!

Correct Answer:

Verified

Depreciation expense = (Origin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Manjarrez Corporation has provided the following information

Q65: Bratton Corporation has provided the following information

Q68: Bourland Corporation is considering a capital budgeting

Q69: Maurer Corporation is considering a capital budgeting

Q69: Colantro Corporation has provided the following information

Q228: Stepnoski Corporation is considering a capital budgeting

Q278: Fontana Corporation is considering a capital budgeting

Q289: Bourland Corporation is considering a capital budgeting

Q290: Annala Corporation is considering a capital budgeting

Q387: The investment in working capital at the