Multiple Choice

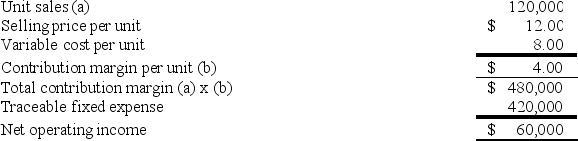

Starowicz Corporation manufactures numerous products, one of which is called Beta10. The company has provided the following data about this product:  Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

A) −$40,800

B) $16,080

C) $379,200

D) $436,080

Correct Answer:

Verified

Correct Answer:

Verified

Q63: Ohanlon Corporation manufactures numerous products, one of

Q64: Boggess Corporation manufactures numerous products, one of

Q65: Morice Industries Inc. has developed a new

Q67: The management of Musselman Corporation would like

Q71: Minden Corporation estimates that the following costs

Q114: In value-based pricing, the value of what

Q180: Blauvelt Electronics Corporation has developed a new

Q194: Willow Corporation manufactures and sells 20,000 units

Q244: Conaghan Avionics Corporation has developed a new

Q317: Thoen Heavy Machinery Corporation has developed a