Multiple Choice

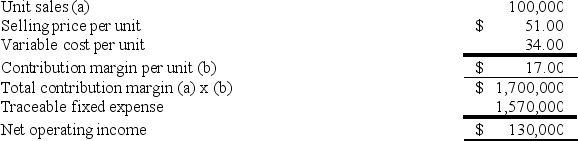

Pascal Corporation manufactures numerous products, one of which is called Gamma66. The company has provided the following data about this product:  Management is considering decreasing the price of Gamma66 by 4%, from $51.00 to $48.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 100,000 units to 110,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Gamma66 earn at a price of $48.96 if this sales forecast is correct?

Management is considering decreasing the price of Gamma66 by 4%, from $51.00 to $48.96. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 100,000 units to 110,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Gamma66 earn at a price of $48.96 if this sales forecast is correct?

A) $(74,000)

B) $1,645,600

C) $75,600

D) $1,496,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: "Trueba Electronics Corporation" has developed a new

Q114: Wermers Industries Inc. has developed a new

Q118: Inscho Corporation manufactures numerous products, one of

Q120: Chruch Corporation manufactures numerous products, one of

Q122: Ritner Corporation manufactures a product that has

Q128: Under the absorption approach to cost-plus pricing

Q158: Gama Avionics Corporation has developed a new

Q203: Ecob Corporation uses the absorption costing approach

Q296: Generally speaking, managers should set higher prices

Q337: Holding all other things constant, if the