Essay

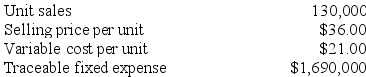

Maccarone Corporation manufactures numerous products, one of which is called Tau10. The company has provided the following data about this product:

Required:

Required:

a. What net operating income is the company earning now on its sales of Tau10?

b. Management is considering decreasing the price of Tau10 by 5%, from $36.00 to $34.20. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 130,000 units to 143,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Tau10 earn at a price of $34.20 if this sales forecast is correct?

c. Assuming that the total traceable fixed expense does not change, if Maccarone decreases the price of Tau10 to $34.20, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $36.00? (Round your answer to the nearest one-tenth of a percent.)

Correct Answer:

Verified

a.

b. The profit at the price of $34.2...

b. The profit at the price of $34.2...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Eytchison Industrial Products Inc.has developed a new

Q82: Blauvelt Electronics Corporation has developed a new

Q106: Aboud Industrial Products Inc.has developed a new

Q116: Timdat Corporation, a manufacturer of moderate-priced time

Q134: Hanisch Corporation would like to use target

Q141: The absorption costing approach to cost-plus pricing

Q196: In target costing, the cost of a

Q246: Tavis Robotics Corporation has developed a new

Q320: Ladle Corporation uses the absorption costing approach

Q366: Most of the opportunities to reduce the