Essay

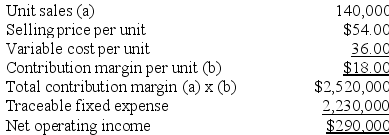

Cabebe Corporation manufactures numerous products, one of which is called Omicron55. The company has provided the following data about this product:

Required:

Required:

a. Management is considering decreasing the price of Omicron55 by 4%, from $54.00 to $51.84. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 140,000 units to 154,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will Omicron55 earn at a price of $51.84 if this sales forecast is correct?

b. Assuming that the total traceable fixed expense does not change, if Cabebe decreases the price of Omicron55 to $51.84, what percentage change in unit sales would provide the same net operating income that it currently earns at a price of $54.00? (Round your answer to the nearest one-tenth of a percent.)

Correct Answer:

Verified

a. The profit at the price of $51.84 per...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Shoun Mechanical Corporation has developed a new

Q53: Kinsley Corporation manufactures numerous products, one of

Q55: Seamons Corporation has the following information available

Q57: Boggess Corporation manufactures numerous products, one of

Q69: Montecalvo Logistic Solutions Corporation has developed a

Q92: The target costing approach was developed in

Q107: Wyler Logistic Solutions Corporation has developed a

Q130: In value-based pricing, the economic value to

Q182: Secore Robotics Corporation has developed a new

Q251: All other things equal including costs, if