Multiple Choice

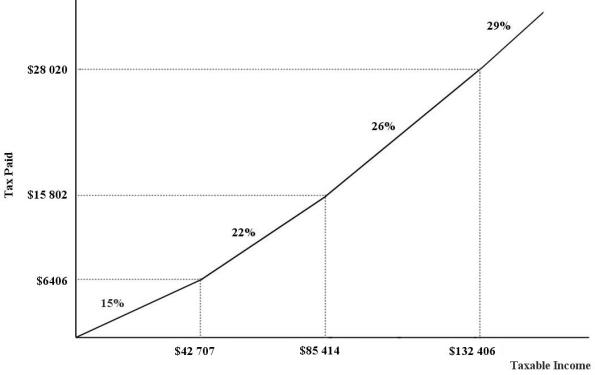

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $98 125 will pay $________ in income taxes.

A) 15 209

B) 18 807

C) 22 513

D) 25 513

E) 28 456

Correct Answer:

Verified

Correct Answer:

Verified

Q86: The direct burden of a tax is

Q87: In Canada,students' tuition fees for post-secondary education

Q88: The table below shows 2015 federal income-tax

Q89: Consider the following statement: "In Canada,there will

Q90: In Canada,publicly provided health care is<br>A)purely a

Q92: In an otherwise efficient market,an excise tax

Q93: Some important taxes are regressive,such as provincial

Q94: As a proportion of Gross Domestic Product

Q95: A tax that takes a smaller percentage

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 18-1 -Refer