Essay

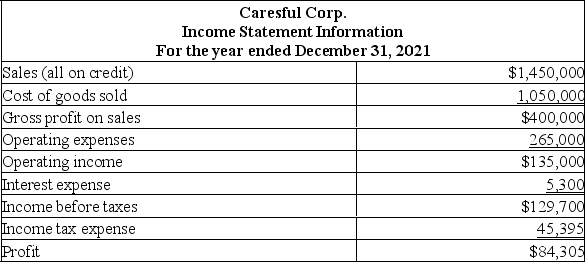

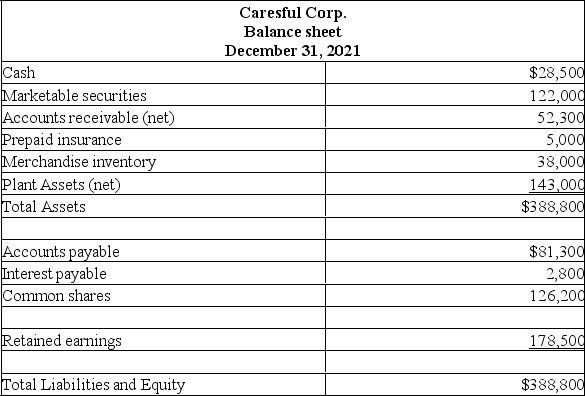

Given the following information from the current financial statements of Caresful Corp,calculate the ratios listed below the financial statements.

(A)Current ratio.(B)Accounts receivable turnover.Assume the beginning of year accounts receivable balance was $59,500.(C)Days' sales uncollected.(D)Merchandise turnover.Assume the beginning of year merchandise inventory was $50,200.(E)Times interest earned.(F)Return on common shareholders' equity.Assume the beginning of year common shares balance was $180,000 and retained earnings was $128,000.(G)Earnings per share (assume Caresful Corp's average common shares outstanding is 50,000).(H)Price-earnings ratio.Assume the company's shares are selling for $26 per share.

(A)Current ratio.(B)Accounts receivable turnover.Assume the beginning of year accounts receivable balance was $59,500.(C)Days' sales uncollected.(D)Merchandise turnover.Assume the beginning of year merchandise inventory was $50,200.(E)Times interest earned.(F)Return on common shareholders' equity.Assume the beginning of year common shares balance was $180,000 and retained earnings was $128,000.(G)Earnings per share (assume Caresful Corp's average common shares outstanding is 50,000).(H)Price-earnings ratio.Assume the company's shares are selling for $26 per share.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In October,Target-Mart had $975,000 in net credit

Q4: For trend analysis,the percent change is completed

Q5: The acid-test ratio<br>A)Is also called the quick

Q6: The following financial data relates to

Q7: The comparative financial statements for Buildmarc Corp

Q9: Markham Corporation had profit of $1,330,000,net sales

Q10: The South Alberta Corp had income tax

Q11: Describe ratio analysis.

Q12: Analytical tools comparing a company's financial condition

Q13: Evaluation of company performance includes<br>A)Past performance<br>B)Current performance<br>C)Current