Essay

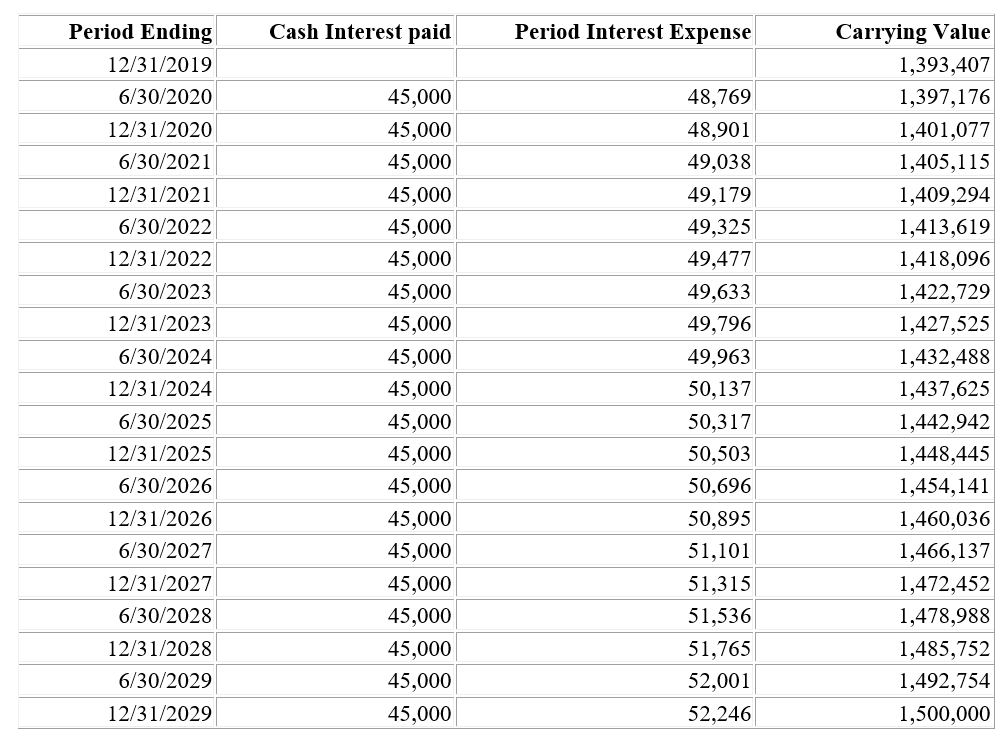

On January 1, 2021, Blue Hat Company issues a bond with a maturity on December 31, 2021. The market rate is 7%. Coupon rate is 6%. Interest is paid each June 30 and December 31. Assume at Dec 31, year end. Blue Hat Company's accounting staff properly prepared a bond amortization schedule below.

-Assume that at Dec 31,2020,the bonds are retired for cash $1,500,000 by the issuer,after interest is paid.Prepare the journal entry and make sure to record either a gain or loss on bond redemption.

Correct Answer:

Verified

Correct Answer:

Verified

Q112: On January 1,2019,Rabo Corporation issued $1,400,000,7%,10-year bonds,and

Q113: Chello Inc issued $200,000,6%,10-year bonds,with interest payable

Q114: Discuss the accounting of a lease by

Q115: Debentures are<br>A)Bonds secured by collateral agreements<br>B)Redeemable bonds<br>C)Another

Q116: A finance lease arrangement is a type

Q118: In recording a finance lease,the lessee debits

Q119: Amortization of a bond discount<br>A)Decreases the Bonds

Q120: On January 1,2020,Korvette Ltd signs a $10,000

Q121: On January 1,2019,a $60,000,6%,6-year installment note payable

Q122: Cannon Ltd bought display racks with a