Essay

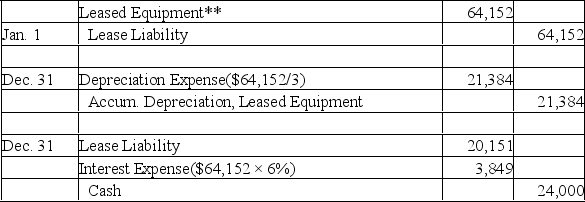

Weta Corporation leases photocopy equipment from Digital Corporation at $24,000 per year for 3 years beginning January 1,2020.The payments are to be made each December 31,beginning in 2020.The lease agreement meets the criteria for a finance lease.The equipment is to be depreciated straight-line over three years.Assuming a 6% effective interest rate,record the entry on January 1,2020,the adjusting entry for depreciation on December 31,2020,and the entry to record the first lease payment.Round all values to the nearest dollar.

Correct Answer:

Verified

** 3 N 6 I/Y 24000 P...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: The effective interest method allocates bond interest

Q90: The market value of a bond is

Q91: Compare the advantages and disadvantages of bond

Q92: Debentures have specific assets of the issuing

Q93: On June 1,2019,when the market rate was

Q95: The contract rate is also called the<br>A)Coupon

Q96: For bonds issued at a premium,the effective

Q97: If a bond is issued at a

Q98: Reckitt Corporation issued $600,000,14%,10-year bonds when the

Q99: Akai Inc borrowed $200,000 from the bank