Essay

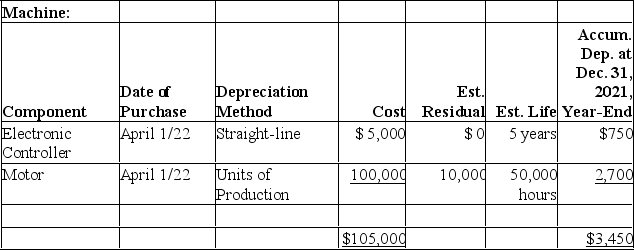

The following information is available for a piece of A Company's machinery:

On November 1,2022,the electronic controller was replaced with a new one costing $8,000 purchased for cash.The new controller had an estimated residual value of $1,000 and an estimated useful life of 5 years.During 2022 the machinery was used for 3,200 hours from January 1 to October 31 and 650 hours from November 1 to December 31.Required: Record depreciation on machinery and the controller replacement for 2022.Round depreciation amounts to the nearest dollar.

On November 1,2022,the electronic controller was replaced with a new one costing $8,000 purchased for cash.The new controller had an estimated residual value of $1,000 and an estimated useful life of 5 years.During 2022 the machinery was used for 3,200 hours from January 1 to October 31 and 650 hours from November 1 to December 31.Required: Record depreciation on machinery and the controller replacement for 2022.Round depreciation amounts to the nearest dollar.

Correct Answer:

Verified

Step 1: Update depreciation on the machi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: On January 4,2020,SportsWorld purchased a patent for

Q46: On April 1,2020,Hogan Industries scrapped a machine

Q47: Hertzog Company purchased and installed a machine

Q48: Hertzog Company purchased and installed a machine

Q49: Intangible assets should be amortized over their

Q51: A new machine is expected to produce

Q52: Prepare journal entries to record the

Q53: Equipment costing $14,000 with accumulated depreciation of

Q54: Impairment losses must be assessed by companies

Q55: Companies are required to use the straight-line