Essay

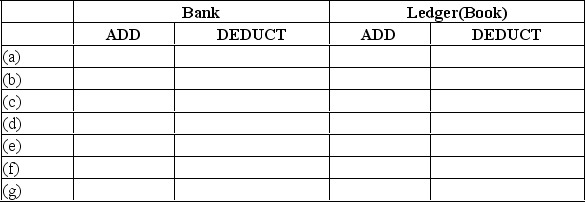

Below, preceded by identifying letters, are seven items that would cause Xavier Sales Company's book balance of cash to differ from its bank statement balance.

(a) A customer's cheque returned by the bank marked "Not Sufficient Funds." A customer's cheque returned by the bank marked "Not Sufficient Funds."

(b) A cheque listed as outstanding on the previous month's reconciliation that is still outstarding:

(c) A service charge made by the bank.

(d) A deposit consisting solely of cheques which was mailed to the bank on the last day of Novernber and is unrecorded on the Novernber bank statement.

(e) A cheque paid by the bank at its correct amount but recorded in error in the Cheque Register at .

(f) An unrecorded credit memorandum indicating the bank had collected a note receivable for Xavier Sales Compary and deposited the proceeds in the compary's account.

(g) A cheque written but not yet paid or retuned by the bank Indicate where each item would appear on Xavier Sales Company's bank reconciliation by putting an "X" in the correct column below.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Two clerks sharing the same cash register

Q84: In reconciling the bank balance, the amount

Q85: An internal control system is the policies

Q86: Internal control over cash receipts ensures that

Q87: A petty cash fund was originally

Q88: The custodian of a $450 petty cash

Q90: The Petty Cash account is a separate

Q91: Cash equivalents<br>A) Are short-term, highly liquid investments<br>B)

Q92: Cash equivalents<br>A) Include savings accounts<br>B) Include chequing

Q93: Separation of duties divides responsibility for a