Essay

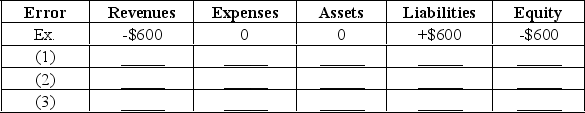

Given the schedule below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements, and a "0" for no effect.(1) Recorded accrued salaries expense of $1,200 with a debit to Prepaid Salaries.(2) The bookkeeper forgot to record $2,700 of depreciation on office equipment.(3) Failed to accrue $300 of interest on a note receivable. Ex. Failed to recognize that $600 of unearned revenues, previously recorded as liabilities, had been earned by year-end.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The adjusted trial balance must be prepared

Q34: Gallery Corp. paid $6,000 for a six-month

Q35: Accrued revenues<br>A) Are paid in advance<br>B) At

Q37: Which of the following accounts is most

Q38: The cash basis of accounting is an

Q40: A company prepays rent of $500 and

Q41: During the year ended December 31, 2020,

Q42: The 12 consecutive months (or 52 weeks)

Q43: Correcting entries are a specialized type of

Q44: External business transactions are transactions between the