Essay

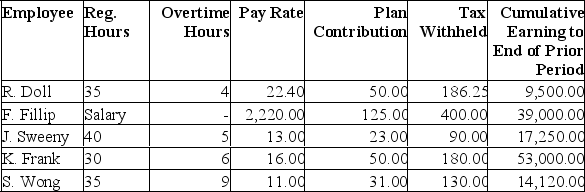

Williams Inc. has collected payroll data for the most recent weekly pay period.

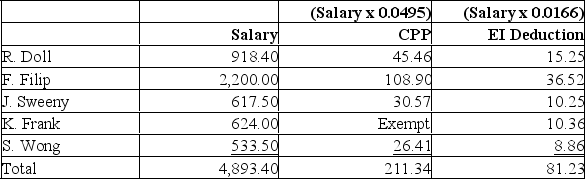

CPP is 4.95% on the annual pensionable earnings of $50,100 ($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company.

CPP is 4.95% on the annual pensionable earnings of $50,100 ($55,900 maximum with the first $3,500 exempt), matched by the employer, and EI is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company.

F.Fillip is an administrative employee, and the other employees are shop workers. Employees are paid time and a half for any overtime work. Prepare the journal entries to record:(a) The payroll accrual.(b) The employer payroll tax expense.(c) The employees' fringe benefits.

*Note that K.Frank would have already paid the maximum CPP and EI for the year.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Employment Insurance is levied equally on the

Q35: In some jurisdictions, paid annual vacation pay

Q36: If a company experiences a low turnover

Q37: Employee income taxes are paid solely by

Q38: A Payroll Register is a record for

Q40: Since federal income taxes withheld from an

Q41: Jack Slack is CEO of Slack Industries.

Q42: Each time a payroll is recorded, a

Q43: Payroll taxes and employee fringe benefits sometimes

Q44: Welch Company has 7 sales employees, each