Essay

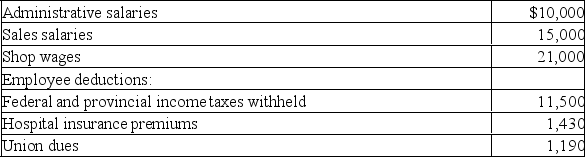

Haines Company prepared the following payroll summary for the current month:

CPP is 4.95% and EI is 1.66%, and none of the current month's salaries and wages exceed the CPP or EI limits. Haines makes a pension contribution equal to 9% of each employee's gross earnings. A vacation pay accrual is also made at 3.6% of the gross earnings. Haines has 10 employees. Prepare the journal entries to record:(A) The month's payroll accrual.(B) The month's employer payroll tax expense.(C) The employer's pension contribution and vacation pay accrual.

CPP is 4.95% and EI is 1.66%, and none of the current month's salaries and wages exceed the CPP or EI limits. Haines makes a pension contribution equal to 9% of each employee's gross earnings. A vacation pay accrual is also made at 3.6% of the gross earnings. Haines has 10 employees. Prepare the journal entries to record:(A) The month's payroll accrual.(B) The month's employer payroll tax expense.(C) The employer's pension contribution and vacation pay accrual.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The amount an employee earns before any

Q11: Employee (fringe) benefit costs represent expenses to

Q12: Payroll taxes levied on employers include Canada

Q13: Since Red River Company experienced very few

Q14: After posting the entries to record salary

Q16: Valentina company has 9 employees who earned

Q17: A payroll deduction required by the federal

Q18: Canada Pension Plan deductions are social security

Q19: The same form is used to report

Q20: Overtime premium pay is not subject to