Multiple Choice

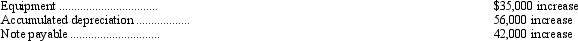

Cotton Corp. reported net income of $420,000 for 2011. Changes occurred in several balance sheet accounts as follows:

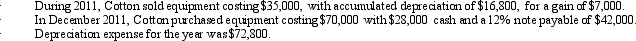

Additional information:

In Cotton's 2011 statement of cash flows, net cash used in investing activities should be

A) $2,800.

B) $16,800.

C) $30,800.

D) $49,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Brown Company reported the following information for

Q2: Net income for the Frost Company for

Q6: In its accrual basis income statement for

Q9: In a statement of cash flows, if

Q10: Dicksen Company's income statement for the year

Q11: UR Company is preparing a forecast of

Q37: Users of financial statements are interested in

Q66: In preparing a statement of cash flows,sale

Q67: Which of the following would be an

Q71: In a statement of cash flows,payments to