Multiple Choice

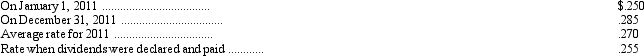

Albright Distributing Inc. converts its foreign subsidiary financial statements using the translation process. Their German subsidiary reported the following for 2011: revenues and expenses of 10,050,000 and 7,800,000 marks, respectively, earned or incurred evenly throughout the year, dividends of 2,000,000 marks were paid during the year. The following exchange rates are available:

Translated net income for 2011 is

A) $641,250.

B) $607,500.

C) $131,250.

D) $97,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following statements is true

Q19: Which of the following is the current

Q32: Which of the following statements regarding international

Q32: Mankato, Inc., purchased Kyoto Manufacturing Company, a

Q34: Under international accounting standards, remote contingent liabilities

Q38: European Trading Company. converts its foreign subsidiary

Q40: Tokyo Enterprises, a subsidiary of Worldwide Enterprises

Q41: Under international accounting standards regarding depreciation, an

Q49: Which of the following is true regarding

Q51: Under international accounting standards,revenue is recognized<br>A) only