Essay

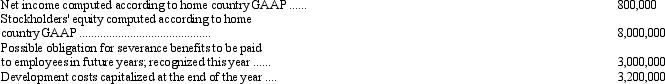

The following financial information is available for Paul Company, a hypothetical non-U.S. firm with shares listed on a U.S. stock exchange:

If Paul were following U.S. GAAP, development costs would be expensed when incurred.

According to U.S. GAAP, the possible obligation for severance benefits would not be recognized until it had become probable.

Prepare a reconciliation of Paul's reported stockholders' equity and net income to the amounts of these items under U.S. GAAP.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A translation adjustment resulting from the translation

Q9: The primary purpose of the Security and

Q37: Under international accounting standards,cash paid for dividends

Q44: Which of the following is not a

Q45: Which of the following is not a

Q46: Under international accounting standards,cash received from interest

Q48: Brown Enterprises, a subsidiary of Biden Company

Q50: Under international accounting standards, deferred tax assets

Q54: Which of the following is the primary

Q54: Which of the following is theleast likely