Essay

Reagan Corporation, a U.S. company, owns a 100% interest in its subsidiary, Thatcher Limited., located in the United Kingdom. Thatcher began operations on January 1, 2010. All revenues and expenses are received and paid in British pounds. The subsidiary maintains its accounting records in British pounds. In light of these facts, management of the U.S. parent has determined that the British pound is the functional currency of the subsidiary.

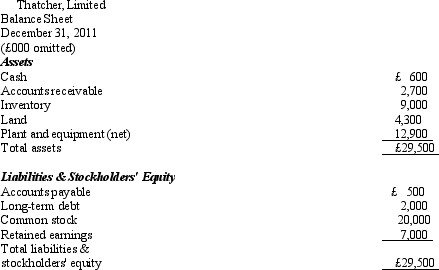

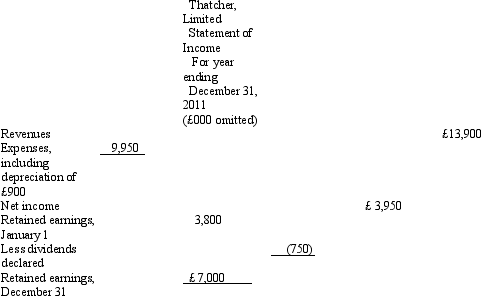

The subsidiary's balance sheet at December 31, 2011, and income statement for the year then ended, are presented below in British pounds:

The following are relevant exchange rates for the year 2011:

£1 = $1.51 at the beginning of 2010, at which time the common stock

was issued.

£1 = $1.55 weighted average for 2011.

£1 = $1.58 at the date the dividends were declared and paid.

£1 = $1.53 at the end of 2011.

£1 = $1.56 at the beginning of 2011.

The balance of the cumulative translation account at January 1, 2011, was $1,157.

Required:

Prepare in U.S. dollars a balance sheet at December 31, 2011, and an income statement for the year then ended for Thatcher, Limited.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Under international accounting standards,the standard for accounting

Q14: Financial information for Toro Enterprises at the

Q16: Which of the following is correct regarding

Q17: Under international accounting standards, if a sale-leaseback

Q18: On July 15, 2011, United Manufacturing Inc.,

Q21: Sunset Technological, Inc., a U.S. multinational producer

Q22: Complete the following statement by choosing the

Q23: The SEC currently requires foreign companies that

Q31: Foreign currency translation adjustments arising from translation

Q53: Which of the following statements is correct?<br>A)