Essay

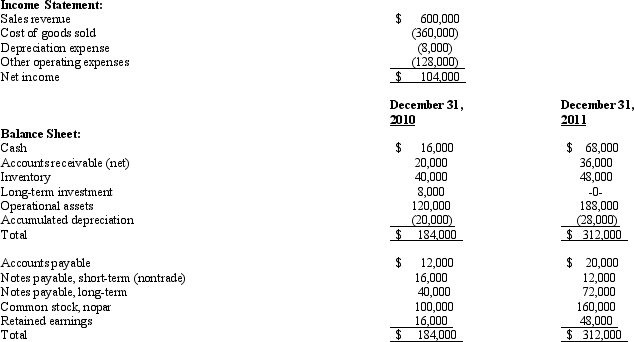

The records of George Company provided the following information for the year ended December 31, 2011:

Additional Information:

1. Sold the long-term investment at cost, for cash. The securities were classified as available-for-sale. The market value had not changed since acquisition.

2. Declared and paid a cash dividend of $28,000.

3. Purchased operational assets that cost $68,000 by giving a $48,000 long-term note payable and by paying $20,000 cash.

4. Paid a $16,000 long-term note payable by issuing common stock having a market value of $16,000.

5. Issued a stock dividend of $44,000.

Required:

Prepare a statement of cash flows using the direct method for George Company for the year ending December 31, 2011.

Correct Answer:

Verified

George Company

State...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

State...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: At the beginning of the year, a

Q11: A company's income statement disclosed $45,000 of

Q14: A firm's accumulated depreciation account increased $30,000

Q15: Which of the following is not an

Q17: In preparing a statement of cash flows,

Q18: Cash inflows from investing activities would include

Q20: Which of the following is a deduction

Q21: The conversion of nonparticipating preferred stock into

Q29: A loss on the sale of machinery

Q62: Which of the following items is included