Essay

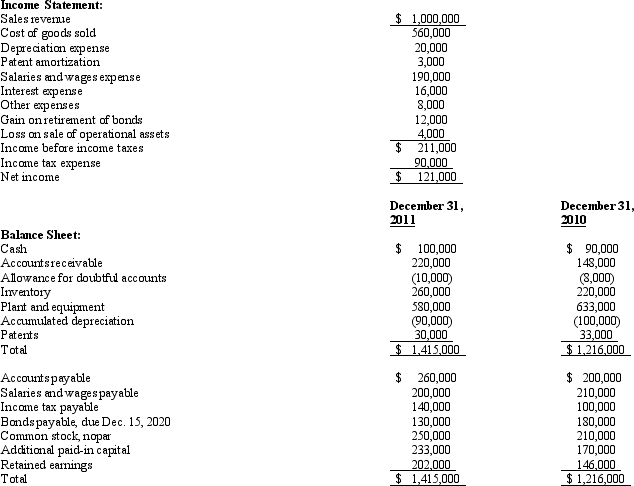

The following information for Wilbur Company is available at December 31, 2011, and for the year then ending:

The following information is available for specific accounts and transactions:

1. On February 2, 2011, Wilbur issued a 10 percent stock dividend to shareholders of record on January 15, 2011. Market price per share of the common stock on February 2, 2011, was $15.

2. On March 1, 2011, Wilbur issued 3,800 shares of common stock for land. The common stock had a current market value of approximately $40,000 on March 1, 2011.

3. On April 15, 2011, Wilbur repurchased its long-term bonds payable with a face value of $50,000 for cash.

4. On June 30, 2011, Wilbur sold for $19,000 cash equipment having a book value of $23,000 and an original cost of $53,000.

5. On September 30, 2011, Wilbur declared and paid a 4 cent per share cash dividend to shareholders of record on August 1, 2011.

6. On October 1, 2011, Wilbur purchased land for $85,000 cash.

Required:

Prepare a statement of cash flows for Wilbur Company for the year ending December 31, 2011, using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: What is the effect of the sale

Q5: Assume cash paid to suppliers for 2011

Q6: Jackson Company began the current year with

Q8: At the beginning of the year, a

Q11: A company's income statement disclosed $45,000 of

Q13: A loss on the sale of machinery

Q21: The conversion of nonparticipating preferred stock into

Q29: A loss on the sale of machinery

Q40: Which of the following causes a change

Q53: Which of the following items involving current