Essay

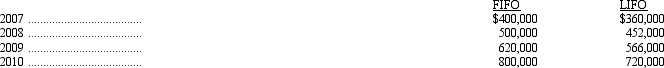

On January 1, 2011, Wiley Corporation changed its inventory cost flow assumption from FIFO to LIFO. The change was made for financial statement and tax reporting. Wiley's inventory values at the end of each year since inception under both methods are summarized below.

Ignoring income taxes, what is the amount of adjustment required in the 2011 accounts, and where would it be reported in the financial statement?

Correct Answer:

Verified

The change is an exception to the genera...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: For a company with a periodic inventory

Q41: An accounting change that requires the retrospective

Q42: Barker, Inc. receives subscription payments for annual

Q43: Badger Corporation purchased a machine for $150,000

Q47: On December 31, 2011, Buckeye Corporation appropriately

Q48: On January 1, 2008, Grayson Company purchased

Q49: Since its organization on January 1, 2009,

Q50: At the time Fisher Corporation became a

Q51: On January 2, 2009, McKell Company acquired

Q69: Which of the following statements is not