Multiple Choice

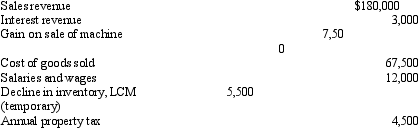

Marshall Company reported the following data with regard to its first quarter of operations:

The expected annual income tax rate is 40 percent. Marshall should report net income on the first quarter interim financial statements of

A) $0.

B) $61,425.

C) $63,225.

D) $65,925.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Information obtained prior to the issuance of

Q57: A company enters into a futures contract

Q58: On January 1, 2011, Cougar Company received

Q59: Cosmos Corporation sells five different types of

Q60: Maxwell Corporation was involved in a lawsuit

Q61: Which of the following is not true

Q64: A contingent loss should be disclosed in

Q66: Uncertainty that the party on the other

Q67: Which of the following measures is not

Q79: In exchange for the rights inherent in