Multiple Choice

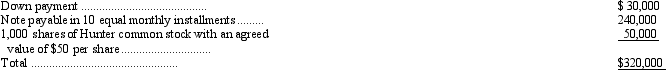

In January, Hunter Corporation entered into a contract to acquire a new machine for its factory. The machine, which had a cash price of $300,000, was paid for as follows:

Prior to the machine's use, installation costs of $8,000 were incurred. The machine has an estimated useful life of ten years and an estimated salvage value of $10,000. What should Hunter record as depreciation expense for the first year under the straight-line method?

A) $29,800

B) $30,000

C) $31,000

D) $31,800

Correct Answer:

Verified

Correct Answer:

Verified

Q58: In order to calculate the third year's

Q59: A method that ignores salvage value in

Q69: A recently issued FASB standard requires that

Q74: The Fitzsimmons Company applied for and received

Q76: Monier Carpet traded cleaning equipment with a

Q77: Legal fees incurred in successfully defending a

Q78: Pastel Co. purchased a patent on January

Q82: During 2006, Volvo Machine Company spent $352,000

Q83: A depreciable asset has an estimated 15

Q84: Which of the following is not required