Multiple Choice

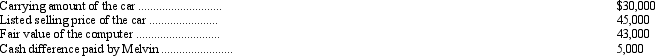

Melvin Motor Sales exchanged a car from its inventory for a computer to be used as a noncurrent operating asset. The following information relates to this exchange that took place on July 31, 2011:

The exchange has commercial substance.

On July 31, 2011, how much profit should Melvin recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following depreciation methods most

Q34: On January 1, 2010, Herschel Locks Corporation

Q36: On December 2, 2011, Part Company, which

Q38: On January 1 Stockton Company acquired a

Q40: Which of the following assets generally is

Q40: The Chase Company exchanged equipment costing $240,000

Q42: In October 2011, Daryl Company exchanged a

Q43: Seaver Inc. exchanged a machine costing $400,000

Q44: Tillman Company owns a machine that was

Q56: Depreciation of noncurrent operating assets is an