Essay

Hearsa Manufacturing Inc. purchased a new machine on January 2, 2011, that was built to perform one function on its assembly line. Data pertaining to this machine are:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

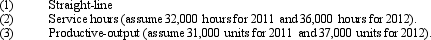

Using each of the following methods, compute the annual depreciation rate and charge for the years ended December 31, 2011, and 2012:

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The sale of a depreciable asset resulting

Q12: In 2010, Newman Company paid $1,000,000 to

Q14: In recording the trade of one asset

Q15: On January 1, 2011, Carson Company purchased

Q16: Dewey Company purchased a machine that was

Q17: The impairment test for an intangible asset

Q18: Ellis Construction Company recently exchanged an old

Q19: Bingham Mining Company has a copper mine

Q21: Which of the following depreciation methods applies

Q22: Luther Soaps purchased a machine on January