Essay

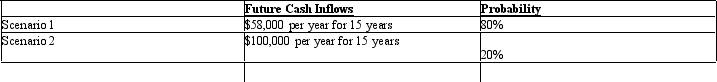

Anaconda Mining Company has a copper mine in Nevada operating at a reduced level of production for the past two years. The market for copper has been adversely affected by weak prices, low demand, and foreign competition. Management believes that the market likely will improve next year and does not plan to abandon this facility. Nevertheless, the controller of the company plans to test the plant and equipment of the operation for impairment due to the decrease in its use. The plant and equipment used in this operation were acquired five years ago for $1,600,000 and have been depreciated using straight-line depreciation over a 20-year life with no residual value. The controller estimates that the assets have a remaining useful life of 15 years and that the following two cash flow scenarios are possible, with the indicated probabilities:

The fair value of the plant and equipment is estimated to be $890,000.

Prepare the entry (if any) required to recognize the impairment loss.

Correct Answer:

Verified

Book value of plant and equipment:

Cost ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Cost ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Which of the following depreciation methods most

Q27: Which of the following reasons provides the

Q42: In October 2011, Daryl Company exchanged a

Q43: Seaver Inc. exchanged a machine costing $400,000

Q44: Tillman Company owns a machine that was

Q45: In January 2011, Butz Company exchanged an

Q47: XYZ Corporation bought a machine on January

Q48: On June 30, 2011, a fire in

Q50: Jordan Company exchanged a used autograph-signing machine

Q51: Malone Company traded in an old machine