Multiple Choice

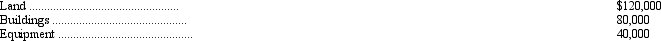

The Oscar Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $180,000. At the time of acquisition, Oscar paid $12,000 to have the assets appraised. The appraisal disclosed the following values:

What cost should be assigned to the land, buildings, and equipment, respectively?

A) $64,000, $64,000, and $64,000

B) $90,000, $60,000, and $30,000

C) $96,000, $64,000, and $32,000

D) $120,000, $80,000, and $40,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: When a company replaces an old asphalt

Q37: Which of the following is true regarding

Q42: Which of the following most accurately describes

Q51: Blocker Company recently acquired two items of

Q53: Broadcast rights are an example of which

Q54: The Callister Company exchanged 25,000 shares of

Q55: Which of the following intangible assets does

Q59: During the year just ended, Morton Company

Q61: The term "intangible assets" is used in

Q78: Which of the following ordinarily would be