Multiple Choice

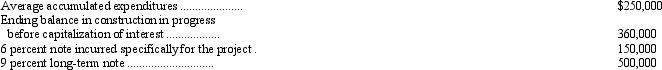

Jazz company started construction on a building on January 1 of this year and completed construction on December 31 of the same year. Jazz had only two interest notes outstanding during the year, and both of these notes were outstanding for all 12 months of the year. The following information is available:

What amount of interest should Jazz capitalize for the current year?

A) $15,000

B) $18,000

C) $22,500

D) $27,900

Correct Answer:

Verified

Correct Answer:

Verified

Q7: On October 1, Takei, Inc. exchanged 8,000

Q8: On February 12, Laker Company purchased a

Q9: Jazz Company acquired land and paid for

Q10: On March 1, 2011, the Sefkwak Company

Q11: During 2011, Grant Industries, Inc. constructed a

Q13: One of the most critical steps in

Q14: RGW Industries purchased the net assets

Q16: The general ledger of the Flayle Corporation

Q17: On September 10, Sandy Company incurred the

Q25: Which of the following is true?<br>A) The