Essay

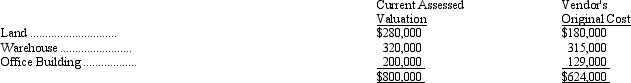

On May 1, 2011, Lenny Corporation purchased for $690,000 a tract of land on which a warehouse and office building were located. The following data were collected concerning the property:

Determine the appropriate amounts that Lenny should record for the land, warehouse, and office building.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A copyright is an example of which

Q19: According to the most current FASB standards,intangible

Q31: Which of the following most accurately describes

Q44: Which of the following concepts is often

Q57: Trade secrets are an example of which

Q73: If the cost of ordinary repairs is

Q76: A donated plant asset for which the

Q80: Gooden Enterprises Inc. developed a new machine

Q81: Lurie Company made the following cash expenditures

Q84: Jazz Company purchased land with a current