Multiple Choice

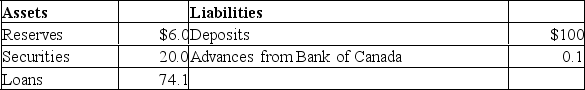

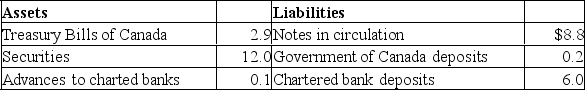

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.The maximum money-creating potential of the chartered banking system is:

Refer to the above information.The maximum money-creating potential of the chartered banking system is:

A) $5

B) $19

C) $20

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q201: In terms of the aggregate demand and

Q202: Restrictive monetary policies are most likely to

Q203: Which of the following would provide the

Q204: An expansionary monetary policy may be less

Q205: The overnight lending rate is:<br>A)higher than the

Q207: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q208: When the Bank of Canada buys bonds

Q209: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Which line in

Q210: Other things equal, an expansionary monetary policy

Q211: Quantitative easing refers to:<br>A)the selling of bonds