Multiple Choice

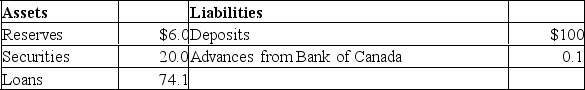

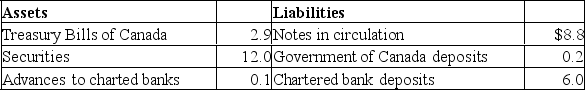

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

A) directly increase by $2 and the money-creating potential of the chartered banking system will increase by $38.

B) directly increase by $40 and the money-creating potential of the chartered banking system will increase by $800.

C) directly increase by $2 and the money-creating potential of the chartered banking system will be unaffected.

D) be unaffected but the money-creating potential of the chartered banking system will increase by $40.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Which of the following best describes the

Q31: Which of the following is correct?<br>A)A restrictive

Q32: An expansionary monetary policy is appropriate for

Q33: An increase in the money supply will

Q34: The prime interest rate:<br>A)affects investment spending while

Q36: Assume that the desired reserve ratio for

Q37: In 2018, the Bank of Canada set

Q38: If nominal GDP is $2,000 billion and

Q39: If the Bank of Canada sells government

Q40: An expansionary monetary policy will decrease net